Shingles Blew Off Roof: Reasons Why and Steps for Immediate Repair

Shingles blew off your roof during the latest storm or a particularly windy day? Don’t panic. In this comprehensive guide, learn immediate steps to protect your home, understand why shingles blew off your roof, and discover how to fix and prevent shingles blew off your roof from happening again.

Key Takeaways

-

Shingles can blow off roofs due to severe weather, aging materials, or improper installation; regular inspections and quality materials can mitigate these risks.

-

Immediate action is vital when shingles are blown off; temporary solutions like tarping can prevent further damage while awaiting permanent repairs.

-

Hiring professional roofers ensures safe and efficient repairs, access to high-quality materials, and can save homeowners time and money in the long run.

Why Do Shingles Blow Off Roofs?

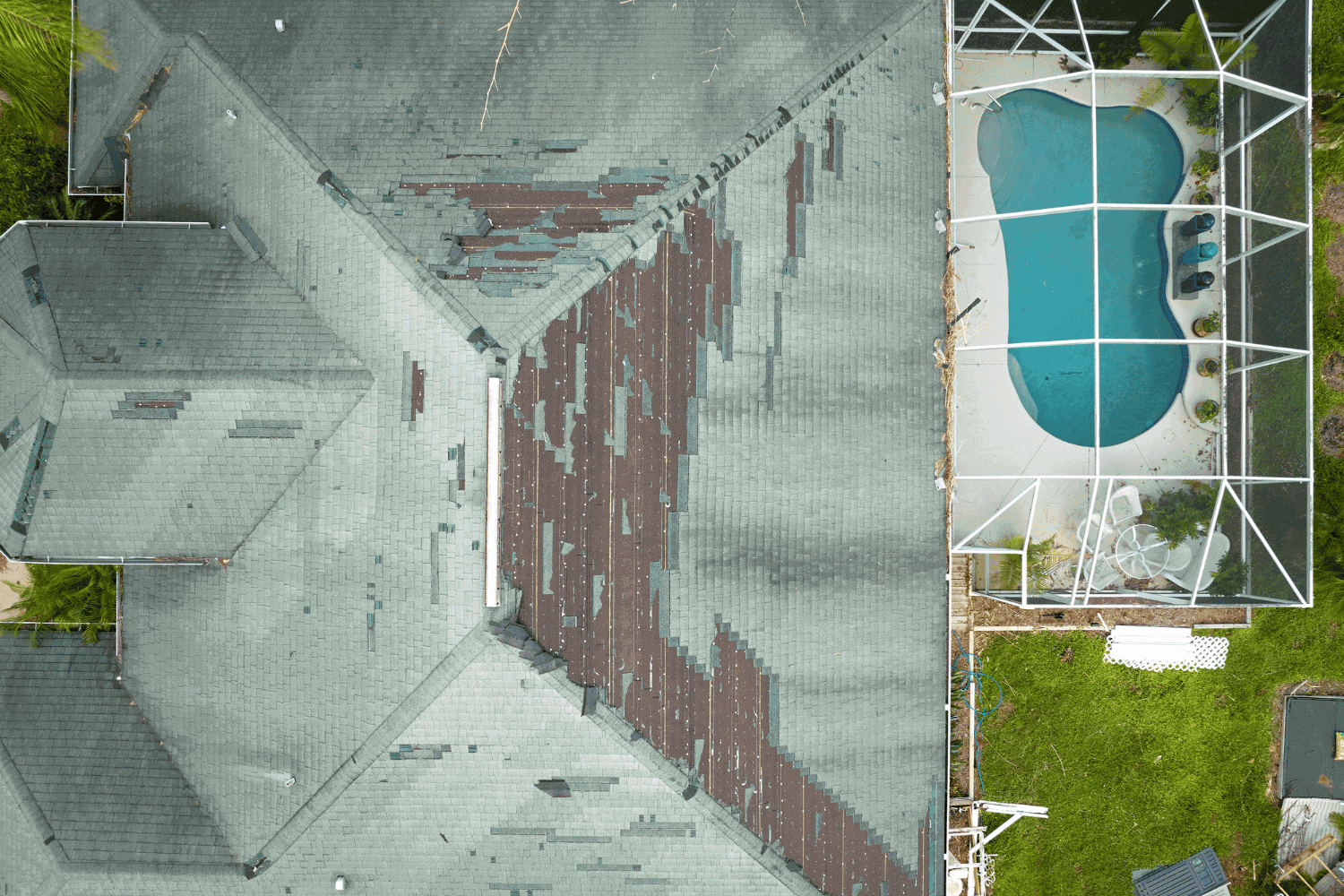

A roof with several shingles missing due to high winds.

Understanding the reasons behind shingles blowing off roofs helps in preventing it from happening to your home. There are several reasons why this occurs, including severe weather conditions, aging roof materials, and improper installation. These factors can weaken roofing shingles, increasing their susceptibility to being dislodged during adverse conditions.

Severe weather, the natural aging process of roofing materials, and improper installation practices are the primary culprits behind shingles blowing off roofs. Exploring these factors in detail provides a better understanding of how to protect your roof and take preventive measures to avoid future issues.

Severe Weather Conditions

Severe weather conditions, such as strong winds and storms, are major contributors to shingles blowing off roofs. High winds can rip shingles from their nails, especially when they are already weakened by age or improper installation. Storms can cause significant roof damage, and regular inspections after such events are crucial to detect any issues early on.

During a storm, the force of the wind can lift roof shingle, breaking the seal that holds them in place. This is why inspecting your roof after storms is essential to prevent further deterioration and costly repairs. Scheduling regular inspections, at least twice a year, can help identify potential problems before they escalate.

Using high-quality roofing materials enhances your roof’s durability against severe weather. Upgrading to more durable materials can significantly decrease the likelihood of shingles blowing off, providing peace of mind and reducing the need for frequent repairs.

Aging Roof Materials

The aging process of roofing materials is another common reason for asphalt shingles blowing off. Asphalt shingle roofs typically last around 20 years. This is their average lifespan. As roofing materials age, they become brittle, lose adhesive properties, and become more prone to being dislodged during high winds or storms.

Signs of aging roofing materials include bald spots, cracks, blisters, curling, and holes. These indicators suggest that the shingles are deteriorating and may not provide adequate protection for your roof. Regular maintenance can help prolong the lifespan of your roofing materials and minimize the risk of weather-related damage.

Older shingles are more likely to sustain wind damage compared to newer ones. This highlights the importance of regular inspections and timely repairs to ensure your roof’s health and longevity. By catching issues early, you can address them before they lead to more severe problems.

Improper Installation

Improper installation practices can significantly increase the likelihood of shingles blowing off roofs. When nails are placed too high on the shingle or improperly driven, they may not secure the shingles effectively, leading to blow-offs. Incorrect nail positioning during installation can reduce the holding power of the shingles, making them more susceptible to high winds and storms.

Poor installation practices often result in loose roofing nails or unadhered adhesive seals. These problems can compromise the integrity of the shingles, making them more likely to become loose and blow off during adverse weather conditions. Having shingles installed correctly by professional roofers prevents these issues and extends the lifespan of your roof.

Identifying Missing Shingles

A roof inspection showing damaged shingles that have blown off.

Early identification of a missing shingle is crucial to preventing further damage to your roof and home. One of the most obvious signs of missing shingles is the presence of darker spots, irregular patterns, and visible gaps on your roof. Regular inspections can help you spot these issues before they lead to more significant problems, such as leaks and structural damage.

Thoroughly inspecting your roof is essential for identifying missing shingles and addressing them promptly. By understanding the signs of roof damage and using the right tools for inspection, you can ensure that your roof remains in good condition and avoid costly repairs in the future.

Signs of Roof Damage

Water stains on your ceilings are indirect signals of missing shingles and potential roof leaks. These stains indicate that water is seeping through the roof, which can lead to significant structural damage if not addressed promptly. Recognizing these signs early can help you take action before the damage worsens.

Other signs of roof damage include visible gaps, loose shingles, and irregular patterns on the roof surface. Regularly checking for these indicators can help you identify issues early and prevent further damage to your home. By staying vigilant and proactive, you can maintain the health of your roof and avoid expensive repairs.

Tools for Inspection

The right tools are crucial for conducting a thorough roof inspection. Binoculars allow you to examine your roof in detail from the ground, reducing the need to climb onto the roof itself. This can be particularly useful for spotting missing shingles, loose shingles, and other signs of damage.

Safety gear, including a sturdy ladder and personal protective equipment, is essential when inspecting your roof. Ensuring that your ladder is on even ground and extends above the roof edge is critical for safety.

Having the proper tools and taking safety precautions can help you conduct a thorough inspection and identify potential issues before they become major problems.

Immediate Steps to Take When Shingles Blow Off

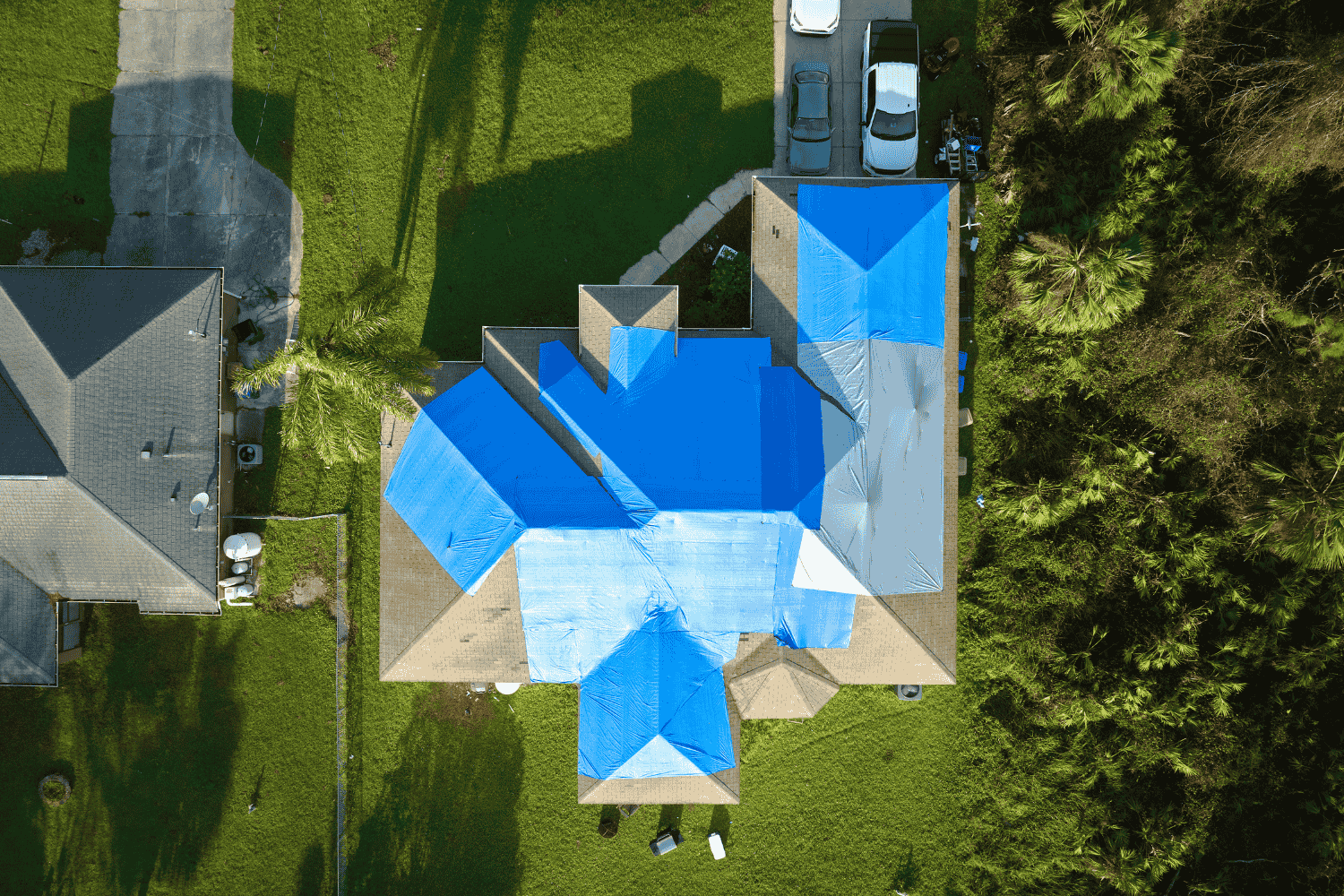

A person taking immediate action to tarp a roof after shingles blew off.

When shingles blow off your roof, it’s important to act fast to prevent further damage. Temporary solutions such as tarping the roof can protect your home from moisture until permanent repairs are made. Ignoring missing shingles can lead to more significant issues, such as water damage and structural problems.

Immediate action upon noticing blown-off shingles can save you time and money in the long run. By promptly addressing the issue, you can prevent further damage to your roof and home and ensure that your roof remains in good condition.

Tarping the Roof

Tarping the roof is a temporary solution that can help prevent further damage when damaged roof shingles blow off. Before getting on the roof, ensure that it is safe and stable to avoid accidents. Make sure the tarp is larger than the damaged area to effectively shield your roof from moisture and leaks.

Secure the tarp with nails or roofing cement to keep it in place until permanent repairs can be made. This temporary measure can help protect your home from further damage and give you time to arrange for professional repairs or gather the necessary supplies for a DIY roof repair.

Safety Precautions

Safety should always be a priority when addressing roof damage. Before climbing onto the roof, check the weather conditions to ensure it is safe to work. Using proper equipment, such as a sturdy ladder and personal protective gear, is essential to avoid accidents and injuries.

Performing roof repairs in mildly warm temperatures is ideal, as shingles can become brittle and difficult to handle in cold weather. Taking these safety precautions can help you conduct repairs safely and effectively, minimizing the risk of accidents and further damage to your repair roof shingles.

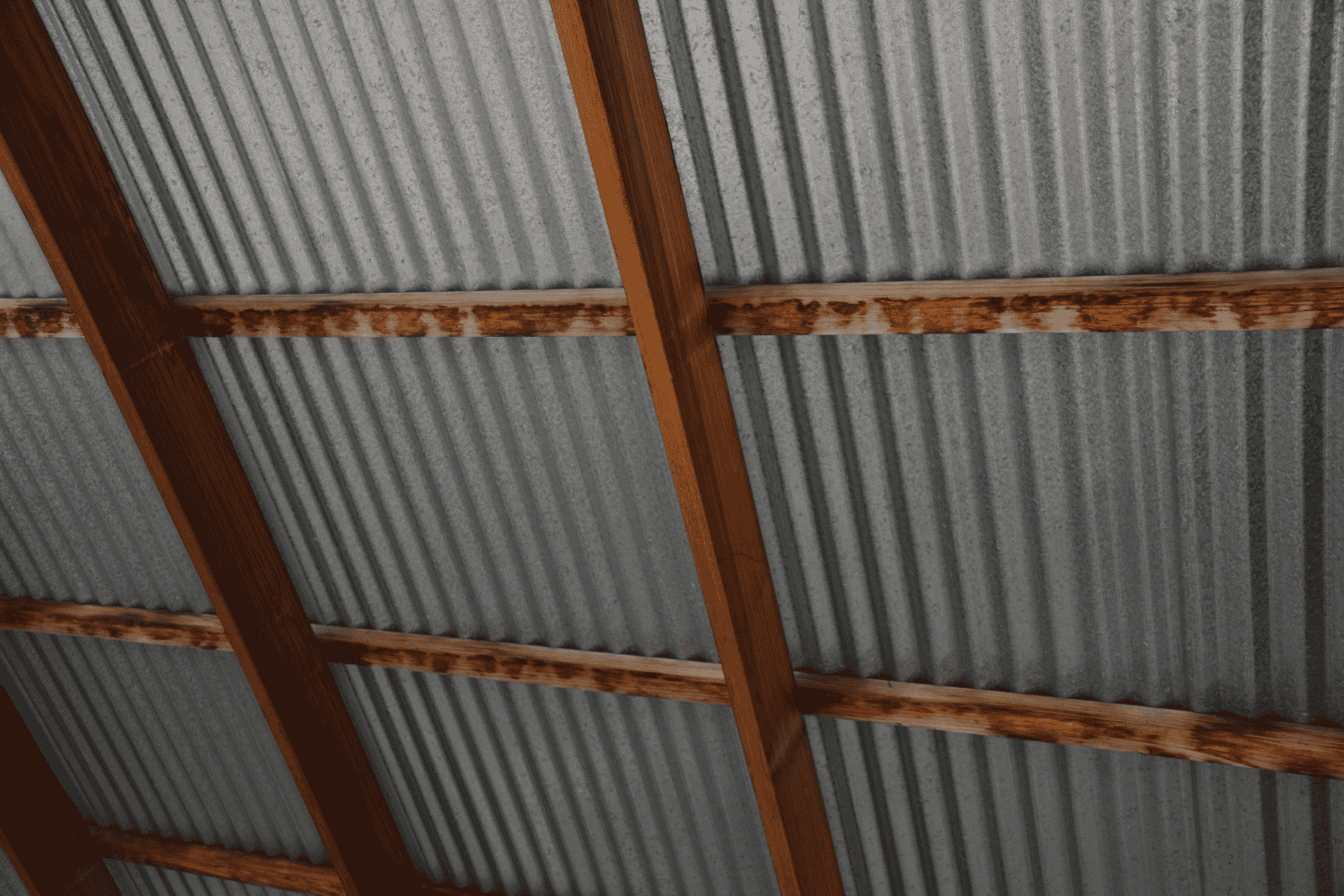

How to Repair Blown Off Shingles

A professional roofer assessing and repairing damaged shingles.

Repairing blown-off shingles involves assessing the damage, removing damaged shingles, and installing new ones to repair roof shingles blown off. It’s important to gather the necessary tools and materials before starting the repair process. By following a step-by-step approach, you can ensure that your roof is properly repaired and protected from future damage.

Assessing the Damage

Start by evaluating the total damage and determining how many new shingles are needed to assess the extent of roof damage. Visible cracks in shingles can lead to water seepage and leaks, so it’s important to address these issues promptly.

Climbing on a roof poses a serious safety risk, especially in bad weather or with debris. Make sure the ladder is on even ground and extends above the roof edge before climbing. These precautions help in assessing the damage safely and effectively.

Removing Damaged Shingles

Removing damaged shingles is a crucial step in the repair process. Begin by inserting a putty knife to break the seal of the damaged shingle. Pry up the damaged shingle with a flat bar, ensuring that the area is clear and ready to replace shingles with new shingles and a replacement shingle.

Dispose of the damaged shingles and nails properly to prepare the area for new shingles. This will ensure that the new shingles can be installed securely and provide adequate protection for your roof.

Installing New Shingles

Installing new shingles involves several steps to ensure a secure and durable repair. Slide the new shingle under the tab of the shingle above and nail it down along the nail strip. Use four nails to secure standard shingles, ensuring they are properly aligned and secured.

Apply roofing cement to seal any nail holes or tears in the roof deck and secure the new shingle. This will help prevent leaks and ensure that the new shingles are properly installed and protected against future damage.

Professional Roof Repair Services

A team of roofing professionals discussing roof repair services.

While DIY repairs can be effective, hiring professional roofers for shingle repairs offers several benefits. Professional teams possess the experience and expertise to complete repairs efficiently and safely. They also have access to high-quality materials that ensure the durability and longevity of the repairs.

Documenting the damage with photographs is crucial for insurance claims, and professional roofers can assist with this process. By hiring professionals, you can save time and money while ensuring that your roof is properly repaired and protected against future damage.

Benefits of Hiring Professionals

Hiring professional roofers provides access to safety measures that reduce risk during repairs. Their extensive experience allows professional teams to complete repairs efficiently, ensuring your roof is secure and protected against future storms.

Investing in superior roofing materials through professional contractors can significantly reduce the frequency of repairs and enhance the durability of your roof. This can save you more money in the long run and provide peace of mind knowing that your roof is in good hands.

Waddle Exteriors’ Roofing Services

Waddle Exteriors offers a range of roofing services tailored for both residential and commercial needs.

With over 40 years of experience, Waddle Exteriors provides comprehensive roofing solutions, including:

-

Residential roofing

-

Commercial roofing

-

Seamless gutters

-

Gutter protection systems

-

Other home improvement products and services

Waddle Exteriors begins our home improvement process with a consultation where experts evaluate roofing needs and answer any questions. Choosing Waddle Exteriors ensures your roof is in the hands of experienced professionals who prioritize customer satisfaction and quality workmanship.

Preventative Measures to Avoid Future Damage

Preventing future damage to your roof is crucial for maintaining your home’s integrity. Regular inspections and investing in high-quality roofing materials are two key strategies that can help you avoid the need for frequent repairs. These preventative measures ensure your roof remains in good condition and is better equipped to withstand severe weather.

Older roofing materials are often more susceptible to damage and loosening from high winds. Professional contractors use high-quality materials that ensure durability and longevity of repairs, which can significantly reduce the risk of shingles blowing off during storms, especially when considering roof replacement.

Regular Roof Inspections

Routine inspections are essential for identifying and addressing potential weak points in your roof. Curling or buckling shingles suggest aging or improper installation, indicating a need for inspection. Evaluating weak points helps keep your home in optimal condition and prevents more significant issues from developing.

Homeowners should arrange regular inspections to manage roof maintenance effectively. Conducting routine check-ups on your roof can identify problems before they develop into significant damage, saving you time and money in the long run.

Quality Roofing Materials

High-quality roofing material ensures the long-term durability of your roof. High-quality roofing can contribute to lower energy costs and a reduced environmental impact. Upgrading your roof material can yield a return on investment of 68%, making it a worthwhile investment for your home.

Granule loss from shingles often indicates deterioration and reduced effectiveness. Choosing high-quality materials enhances your roof’s resilience against severe weather and reduces the frequency of repairs, providing peace of mind and cost savings in the long run.

Summary

In summary, shingles blowing off your roof can lead to significant damage if not addressed promptly. Understanding the reasons behind shingle blow-offs, such as severe weather, aging materials, and improper installation, is crucial for taking preventive measures. Regular inspections and investing in high-quality roofing materials can significantly reduce the risk of future damage.

By following the steps outlined in this guide, you can effectively identify and repair missing shingles, ensuring the longevity and durability of your roof. Whether you choose to undertake DIY repairs or hire professional roofers, taking proactive measures will help protect your home and avoid costly repairs down the line.

Frequently Asked Questions

What are the common reasons shingles blow off roofs?

Shingles often blow off roofs primarily due to severe weather, aging materials, and improper installation techniques. Ensuring proper installation and using high-quality materials can help mitigate this risk.

How can I identify missing shingles on my roof?

To identify missing shingles on your roof, look for darker spots, irregular patterns, and visible gaps. Water stains on the ceiling may also indicate leaks from missing shingles.

What immediate steps should I take if shingles blow off my roof?

Immediately tarp the roof to prevent further damage and ensure safety. Additionally, consider hiring professionals for efficient repair management.

How do I repair blown-off shingles?

To effectively repair blown-off shingles, first assess the damage and remove any compromised shingles by breaking the seal. Then, slide new shingles into place, secure them with nails along the nail strip, and apply roofing cement for added stability.

Why should I hire professional roofers for shingle repairs?

Hiring professional roofers for shingle repairs is essential due to their experience and expertise, which ensures efficient and safe repairs. Their use of high-quality materials not only enhances durability but also minimizes the risk of future problems.